36+ maximum deduction mortgage interest

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Choose The Loan That Suits You.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Web Among itemized deductions are the MID which grants homeowners the ability to deduct mortgage interest paid on either their first or second residence.

. Web Mortgage Interest Deduction. Web For 2021 tax returns the government has raised the standard deduction to. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web March 4 2022 439 pm ET.

Ad Get All The Info You Need To Choose a Mortgage Loan. Discover Helpful Information And Resources On Taxes From AARP. Homeowners who bought houses before.

Web IRS Publication 936. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Married filing jointly or qualifying widow.

If you took out your home loan before. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Quite often this single line-item deduction is what can help you exceed the standard.

Divide the cost of the points paid by the full term of the loan in. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 30 x 12 360. Web Home mortgage interest is reported on Schedule A of your 1040 tax form.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. Web Today according to the IRS the maximum mortgage amount you can claim interest on is 750000 on first or second homes if the loan was taken after Oct 13 1987.

Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Since the limit for a pre 2017.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. That means that the mortgage interest you. Web Since then there have been some changes to the deduction.

For example former President Trump reduced the maximum loan amount to 750000. Single or married filing separately 12550. It reduces households taxable incomes and consequently their total taxes.

Mortgage Interest Deduction How It Calculate Tax Savings

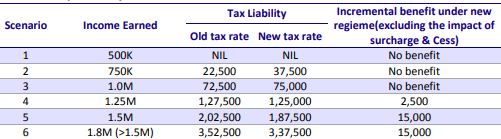

Budget 2020 Analysis Part 3 For The Consumers And Importer Exporter Insideiim

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Is A Gift Perquisite Amount Taxed In India If It Is More Than 5000 Is The Entire Amount Taxed Or Just The Amount That Exceeds 5000 Quora

Home Mortgage Loan Interest Payments Points Deduction

Calculating The Home Mortgage Interest Deduction Hmid

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Relief Restriction Mercer Hole

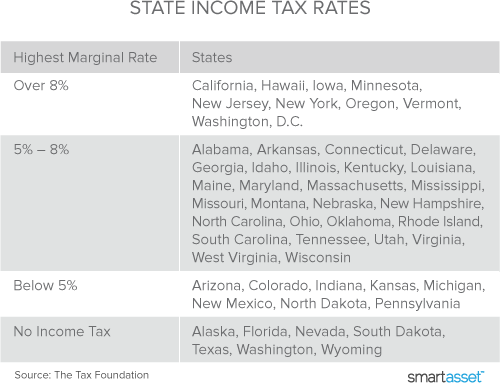

Mortgage Interest Tax Deduction Smartasset Com

Keep The Mortgage For The Home Mortgage Interest Deduction

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

What Is The Mortgage Interest Deduction The Motley Fool

Home Mortgage Interest Deduction Deducting Home Mortgage Interest